Real Financial Skills That Actually Matter

Skip the theory. Learn practical money management from instructors who've built wealth through decades of real-world experience, not textbooks.

Explore Our Approach

Learn from People Who've Actually Done It

Our instructors aren't just teachers—they're people who've navigated market crashes, built investment portfolios, and made (and learned from) real financial mistakes. This hands-on experience shapes every lesson.

-

Real case studies from actual client situations and personal experiences

-

Mentorship that extends beyond course completion into your financial journey

-

Practical tools and frameworks used by working financial professionals

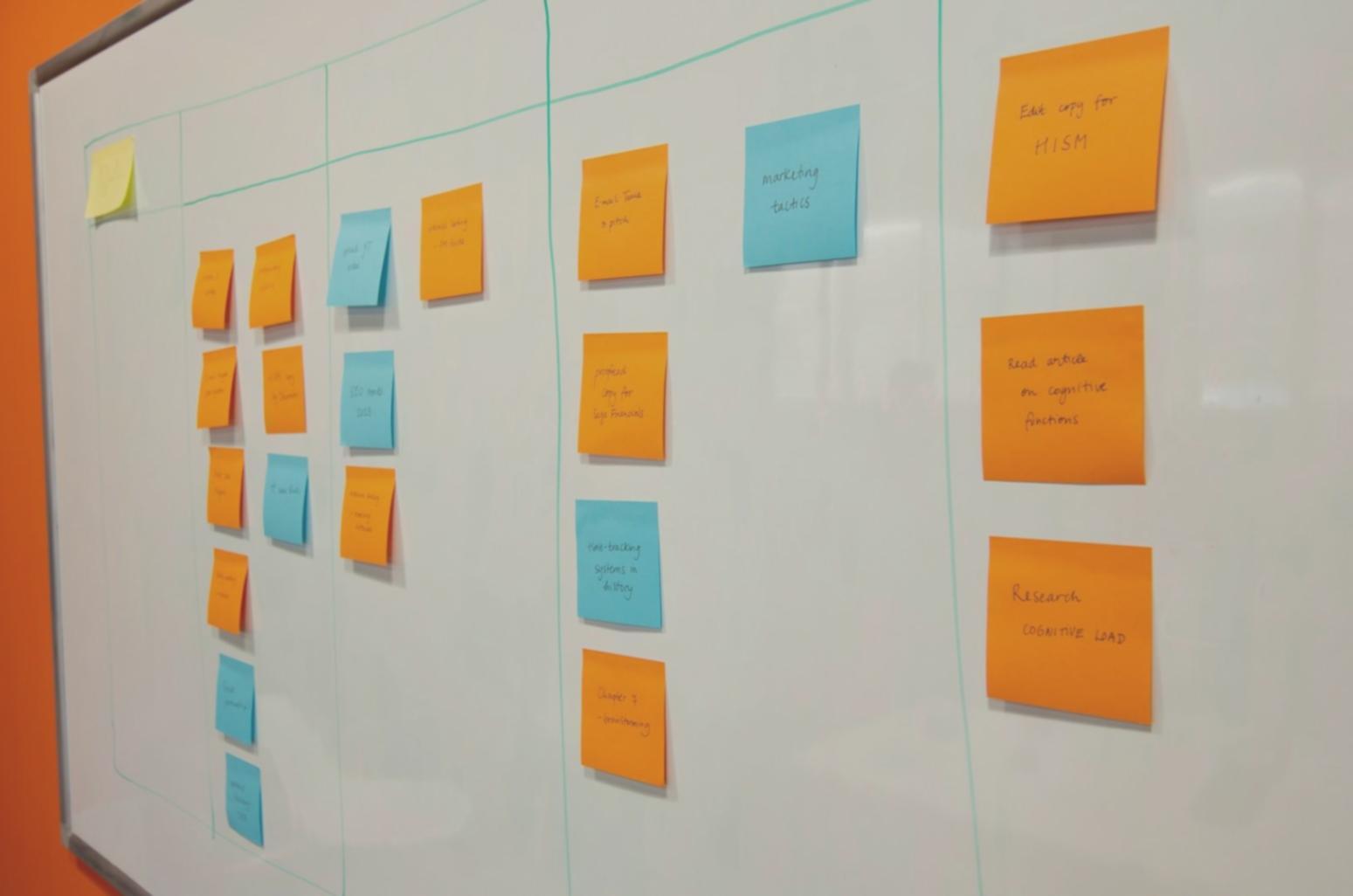

How We Build Financial Expertise

Our methodology focuses on deep analysis of real situations rather than surface-level tips. Each phase builds on actual case studies and practical applications.

Foundation Analysis

We dissect actual financial disasters and successes, identifying decision patterns and underlying principles that determine outcomes.

Strategy Development

Build personalized financial frameworks using lessons from real case studies, adapted to your specific situation and goals.

Implementation Support

Apply strategies with ongoing instructor guidance, troubleshooting real challenges as they emerge in your financial journey.